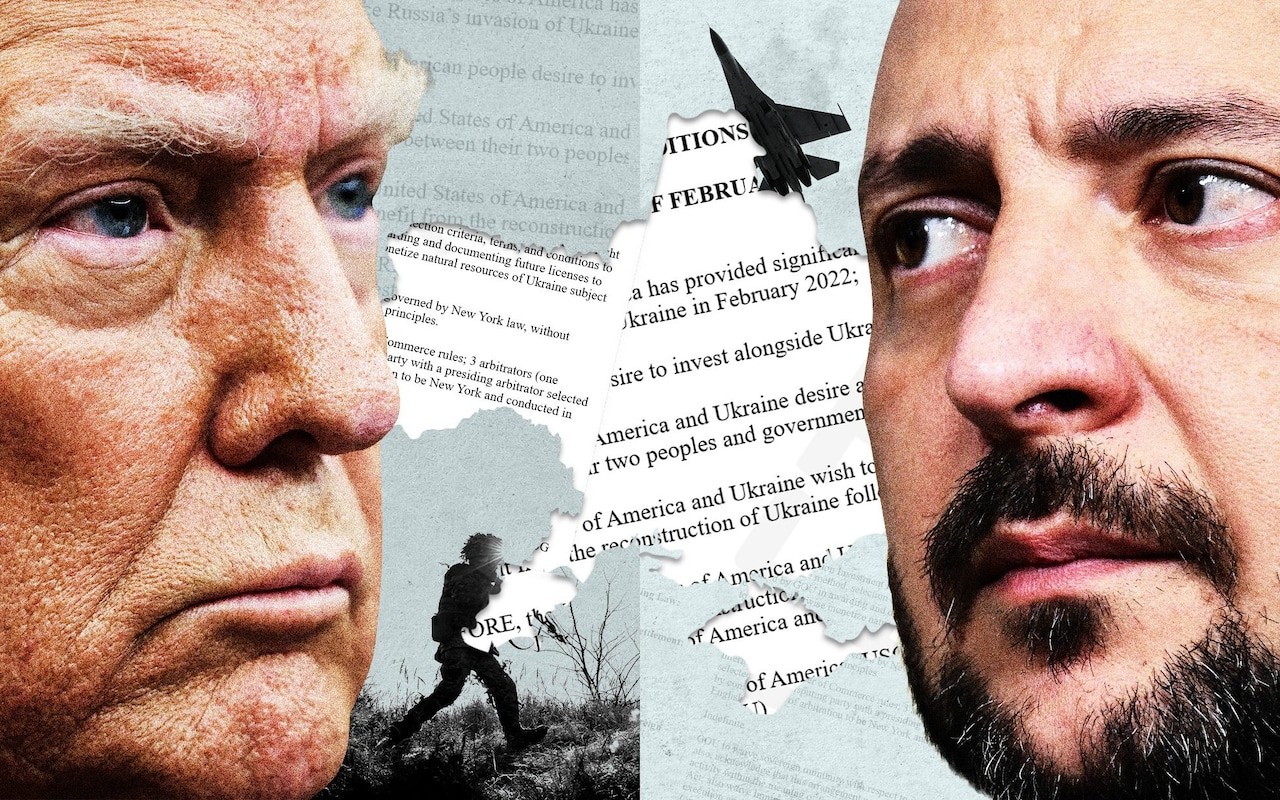

President Donald Trump isn’t sugarcoating it anymore—Ukraine must compensate the West for its military and financial aid with its natural resources. Rare earth metals, oil, gas, and other strategic assets are increasingly dominating Washington’s rhetoric. And while earlier the sum floated was $300 billion, now it’s skyrocketed to $500 billion.

But this isn’t just about money. This is about something far bigger—a calculated move by the U.S. to seize de facto control over Ukraine’s economic future.

A Deal That Changes Everything

Last week, a document landed on President Volodymyr Zelensky’s desk, and calling it anything less than an ultimatum would be an understatement. The draft agreement proposes the creation of an "investment fund" that, on paper, aims to rebuild Ukraine’s economy. But in reality, it cements long-term American control over the country’s natural resources.

This deal is, in essence, economic reparations. It doesn’t just make Ukraine indebted—it turns the nation into a resource colony of the U.S., forcing it to repay war aid not with money, but with its sovereignty. Panic is already spreading through Kyiv as the implications of signing this agreement become painfully clear.

The Trump administration’s demands are explicit: Washington wants a 50% cut of Ukraine’s revenues from rare earth metals and other valuable minerals. On top of that, the U.S. insists on full control over all future mining licenses, granting itself the right of first refusal on any exports. In other words, before Ukraine can profit from its own resources, American companies get to cash in first.

One particular clause in the agreement stands out for its ironclad legal wording: all disputes will be settled under New York State law. This effectively strips Ukraine of any ability to challenge the deal in international courts.

To accelerate the process, U.S. Treasury Secretary Scott Bessent flew to Kyiv on February 13. His visit coincided with Zelensky’s statement that Ukraine is open to discussing a strategic partnership with the U.S.—but only under revised terms. However, the White House took this as an attempt to stall negotiations.

Washington’s message is crystal clear: Ukraine’s military and economic lifeline is now contingent on its willingness to comply. One European diplomat bluntly put it:

"This was a trap for Trump. Ukraine tried to tie resource access to security guarantees, but the lack of specifics allowed Washington to dictate the price."

Does Ukraine Have a Way Out?

The Zelensky administration knows full well that this deal could transform Ukraine into an economic vassal state. But its options are dwindling. The EU is unwilling to compensate Kyiv for walking away from the deal, and any resistance could trigger a drastic reduction in Western aid.

What’s happening is a stark illustration of Trump’s approach—ruthless, transactional, and unapologetically America First. This isn’t charity; it’s hardball business, where Ukraine isn’t a partner, but a debtor.

Zelensky now faces a grim choice:

- Accept Washington’s terms and surrender key sectors to American control.

- Refuse—and risk having military and financial support frozen overnight.

The question is no longer whether Kyiv will sign this agreement. The real question is: Will Ukraine have any economic autonomy left once it does?

Ukraine is bleeding. The war is draining its economy, and Western support is the only thing keeping its military efforts afloat. That’s why, back in September 2024, Zelensky made a bold, unconventional move—he flew to Trump Tower with a proposition.

His offer? A stake in Ukraine’s rare earth metals and critical minerals—in exchange for continued U.S. weapons shipments.

The logic was simple: bind America’s long-term interests to Ukraine, creating a political tripwire that would deter further Russian aggression. Zelensky even emphasized that some of these mineral deposits lie near the front lines or in Russian-occupied areas, making them strategically vital. Ukraine holds reserves of titanium, tungsten, uranium, graphite, and rare earth elements—all of which Washington would rather keep out of Moscow’s hands.

"If this is a deal, let’s make a deal. We’re all for it," Zelensky said at the time.

But he likely never expected this move to turn into a trap with no exit.

Versailles of the 21st Century

The draft agreement that landed in Zelensky’s office sent shockwaves through even his closest advisors. The terms were so brutal they echoed the reparations imposed on Germany under the Treaty of Versailles in 1919.

The United States is demanding $500 billion in compensation from Ukraine—an obligation relative to GDP that surpasses even the post-war payments forced on Germany and Japan after 1945.

Washington wants to control 50% of all revenues from mineral extraction and 50% of the value of all new licenses issued to third parties. On top of that, the agreement is locked under New York State law, leaving Ukraine with zero legal recourse to challenge its terms in international courts.

In practice, this means the U.S. is taking control of Ukrainian ports, the oil and gas industry, and key infrastructure assets. The deal solidifies the country’s de facto economic occupation.

President Donald Trump has made no effort to sugarcoat his stance. In an interview with Fox News, he laid it out bluntly:

"Ukraine has, in essence, agreed to hand over $500 billion to the U.S. They have incredibly valuable land in terms of rare earth metals, oil, gas, and much more."

But it was his next statement that truly shook Kyiv:

"They can make a deal, or they can walk away. They can become part of Russia, or they can avoid that. But I want my money back."

This sent an earthquake through the Ukrainian government. If Kyiv rejects Washington’s terms, it risks losing not just military aid but also its future as an independent state.

Trump also claimed that the U.S. has already spent $300 billion on Ukraine’s war effort, though the actual numbers are far lower. Out of the $175 billion allocated by Congress, $70 billion was funneled into the U.S. arms industry, and a large portion of the remaining aid came in the form of lend-lease loans—which Ukraine is expected to repay.

Senator Lindsey Graham, speaking at the Munich Security Conference, called Trump’s demand "a smart move", arguing that it would help justify continued support for Ukraine to the American electorate:

"Now he can tell Americans: ‘Ukraine isn’t a burden—it’s a profit center.’"

But behind this "profit center" is a harsh reality: if the agreement is signed, Ukraine will no longer control its own resources. American corporations will dictate who gets access, under what conditions, and at what cost.

A Resource “Superpower” or Just a Mirage?

Amid this high-stakes battle, Western media have started hyping Ukraine’s supposed vast natural wealth, with some analysts estimating its mineral and hydrocarbon reserves at $26 trillion. But the truth is far less glamorous:

- Lithium reserves are sizable, but prices have collapsed 88% since 2022, making extraction barely profitable.

- Rare earth metals aren’t actually that rare, and the U.S. abandoned its own mining operations in the 1990s due to poor profitability.

- Shale gas? Some of Ukraine’s most promising reserves are under Russian control, and extraction in the Carpathians comes with massive logistical and environmental costs.

In reality, the "gold mine" of Ukrainian resources is overhyped—the real benefit for the U.S. isn’t economic, but geopolitical. Controlling these assets means controlling Ukraine’s future, its economy, and its leverage on the world stage.

"In business, the best deal is the one you never make," Trump likes to say.

But Ukraine doesn’t have that luxury.

Zelensky’s Impossible Choice

Zelensky now faces a dilemma with no good options. Rejecting the deal could mean military aid dries up, but signing it means surrendering economic sovereignty.

Caught between Putin’s military invasion and Washington’s economic invasion, Zelensky has only one path left—finding a third power to counterbalance total dependence.

But with time running out and allies growing scarce, the question is: Does Ukraine have any cards left to play?

The Myth of Ukraine’s Vast Wealth

The idea that Ukraine is sitting on trillions of dollars' worth of natural resources is gaining traction in the media. Some sources throw around astronomical figures, estimating the country’s mineral wealth at $26 trillion. But dig a little deeper, and the reality becomes far less impressive.

Before the war, Ukraine earned roughly $24.5 billion annually from exporting ore and metals. But here’s the kicker—none of that revenue came from rare earth metals. Ukraine simply doesn’t produce them at an industrial scale.

Even if Kyiv suddenly launched full-scale extraction of lithium, graphite, and other critical minerals, the total revenue wouldn’t exceed $1 billion per year. By Trump’s logic, it would take at least 20 years for Ukraine to cover the demanded amount.

And that’s assuming everything goes perfectly—an unlikely scenario. Most deposits are either destroyed by the war, owned by private companies, or under Russian control.

Washington is trying to sell Ukraine as the next global leader in rare earth production, but the truth is industrial-scale mining of these resources in Ukraine is virtually impossible.

According to the U.S. Geological Survey (USGS), Ukraine lacks rare earth deposits suitable for large-scale extraction.

Yes, the country does contain lanthanum, cerium, neodymium, and other elements, but these figures are unverified by independent studies, and no commercial mining is taking place.

Even in a fantasy scenario where Ukraine somehow becomes "the next China", its revenue from rare earths would still be negligible.

For perspective:

- China—the world’s largest producer—earns only $500 million annually from exporting rare earth metals.

- Even under the best-case scenario, Ukraine would need 600 to 1,000 years to pay back even the theoretical amount of "debt" the U.S. is demanding.

Ukraine’s Lithium Reserves: A Game-Changer or a Mirage?

Ukraine does hold significant lithium reserves, a key resource for batteries, electronics, and military tech.

According to USGS data, Ukraine’s lithium deposits are estimated at 500,000 metric tons, making it one of the richest lithium reserves in Europe.

Sounds promising, right? Not so fast.

- Mining hasn’t even started.

- Of the four known deposits, two—Shevchenkivske (Zaporizhzhia region) and Kruta Balka (Donetsk region)—are now under Russian control.

Graphite is another strategic mineral that Ukraine does have in abundance. The country holds around 20% of the world’s graphite reserves.

But here’s the problem:

- Zavalievsky Graphite, Ukraine’s only major graphite producer, shut down in 2024.

- Without active mining, this resource remains untapped and commercially useless.

Steel has always been a key part of Ukraine’s economy, but its golden days are long gone.

Yes, in 2023, steel production in Ukraine increased by 21%, reaching 7.6 million metric tons. But that’s still three times lower than pre-war levels and represents less than 0.5% of global steel consumption (1.8 billion metric tons per year).

And the outlook isn’t getting any better.

- The Pokrovska coal mine in Donetsk, Ukraine’s only source of coking coal (needed for steel production), is lost.

- One of the mine’s shafts was blown up in late 2023, and heavy fighting continues in the area.

- Without importing coal, Ukraine’s steel industry will collapse.

As for aluminum? Ukraine’s only aluminum plant—Zaporizhzhia Aluminum Works—has been reduced to a shell of its former self.

- Kyiv has been searching for investors to restart production, but so far, no luck.

- Ukraine has now become a net importer of aluminum.

Translation: Neither steel nor aluminum can be used as "payment" to the U.S.

Donald Trump insists that Ukraine could compensate its debt with oil and gas.

The numbers say otherwise.

According to RBC-Ukraine, as of 2023, Ukraine’s proven oil reserves stand at 107 million metric tons.

What does this actually mean?

- 107 million tons = just 7 days of global oil consumption (the world burns through roughly 14 million tons per day).

- Even if Ukraine sold every drop of its oil at market price, the total revenue would be $7.5 billion.

- That’s less than 2% of the $500 billion Trump wants.

And even this theoretical scenario is impossible, because Ukraine already consumes around 10 million tons of oil annually—meaning it relies on imports to meet domestic demand.

The numbers speak for themselves: Ukraine simply doesn’t have the resources to "pay back" the U.S.

- Rare earths? Unrealistic—no large-scale mining, no proven deposits, no existing industry.

- Lithium? Possible, but not in the short term—major deposits are under Russian control.

- Graphite? Valuable, but Ukraine’s only producer is out of business.

- Steel and aluminum? Dying industries, unable to compete globally.

- Oil and gas? Insufficient reserves, and Ukraine already depends on imports.

Trump’s "Ukraine can pay with resources" narrative is a political talking point, not an economic reality.

And for Zelensky, the nightmare continues: With dwindling options and mounting pressure from Washington, Kyiv is running out of moves in this high-stakes game.

Ukraine’s Gas Problem Is Even Worse

- Back in Soviet times, Ukraine was one of the largest gas producers in the USSR, but production plummeted in the 1980s.

- Today, proven gas reserves stand at 680 billion cubic meters.

- But due to the war, annual production (20 bcm) has dropped, and most gas fields are now in active combat zones.

As for shale gas extraction, Ukraine already abandoned the idea in the 2010s, just like Poland, where similar projects failed due to low profitability and environmental concerns.

Simply put, neither oil nor gas can be a realistic source of repayment for U.S. aid.

Trump’s claim that Ukraine “owes” the U.S. $500 billion and can pay it off with natural resources is nothing more than a political myth.

The facts tell a very different story:

- Rare earth metals? Ukraine doesn’t mine them, and the known deposits are either still being explored or under Russian control.

- Metallurgy? Ukraine’s steel industry is now three times smaller than before the war, and aluminum production has been all but destroyed.

- Oil and gas? Ukraine relies on imports and doesn’t have excess reserves to export.

At its core, Trump’s demand isn’t about money—it’s about leverage.

Washington has long sought to reduce its dependence on China for rare earth metals. The U.S. has been investing in mining projects in Canada and Greenland, but progress has been slow.

Trump is now using Ukraine as a bargaining chip. He doesn’t actually expect to get $500 billion worth of rare earth metals—he’s creating a new tool of pressure.

Ukraine Can’t Pay—So What Happens Next?

Ukraine cannot meet Trump’s demands. Its natural resources aren’t enough, and even if they were, developing them would take decades.

But rejecting the deal comes with a high price—the risk of American aid being frozen.

Kyiv is already trapped between military and economic invasion.

Now, Zelensky faces an impossible choice:

- Give up whatever Ukraine has left to keep U.S. support, or

- Risk losing military aid and being left to fend for itself.

Trump has issued his ultimatum.

The real question is: How far is Zelensky willing to go to keep Washington on his side?